Pros, cons and pragmatism: Biden’s plan to fund infrastructure

Biden’s American Jobs Plan appears popular, but raising corporate taxes to pay for it is not seen by all as a silver bullet.

Two years ago, candidate Joe Biden began his election campaign in Pittsburgh with a promise to rebuild the backbone of the United States. Last week he returned to Steel City as the United States President, bearing a simple message about who will foot the bill.

Big corporations.

Keep reading

list of 4 itemsA pretty penny: Cost of Biden infrastructure plan may not matter

Biden says his infrastructure plan would create 19 million jobs

Does Biden’s American Jobs Plan go big enough on climate change?

“Wall Street didn’t build this country. You, the great middle class, built this country,” said Biden.

Biden said the bulk of his proposed $2.25 trillion American Jobs Plan would be funded by partially rolling back the 2017 corporate tax cut under former President Donald Trump that slashed the rate from 35 percent to 21 percent.

Biden wants to hike the corporate tax rate back up to 28 percent – and overhaul other parts of the tax code to reduce incentives for big companies to shift production, jobs and profits overseas.

The US Department of the Treasury estimates these changes could generate some $2.5 trillion in corporate tax revenue over 15 years – enough to fund the nationwide infrastructure upgrade Biden is pitching.

Tax avoidance strategies have enabled some big US firms to dramatically lower their federal corporate tax bills – even to zero in some cases.

To stop firms from shifting profits abroad to lower-tax jurisdictions, Biden’s plan involves getting other big economies to agree to a global minimum tax rate – an idea spearheaded by US Treasury Secretary Janet Yellen who wrote in the Wall Street Journal on Wednesday: “Destructive tax competition will only end when enough major economies stop undercutting one another and agree to a global minimum tax.”

Republicans in Congress have been pushing back on the American Jobs Plan, criticising it as too costly and too broad in scope.

On Wednesday, Biden signalled he is open to dialogue. “We’ve got to pay for this,” he said. “There are many other ways to do it. I’m open to negotiate this.”

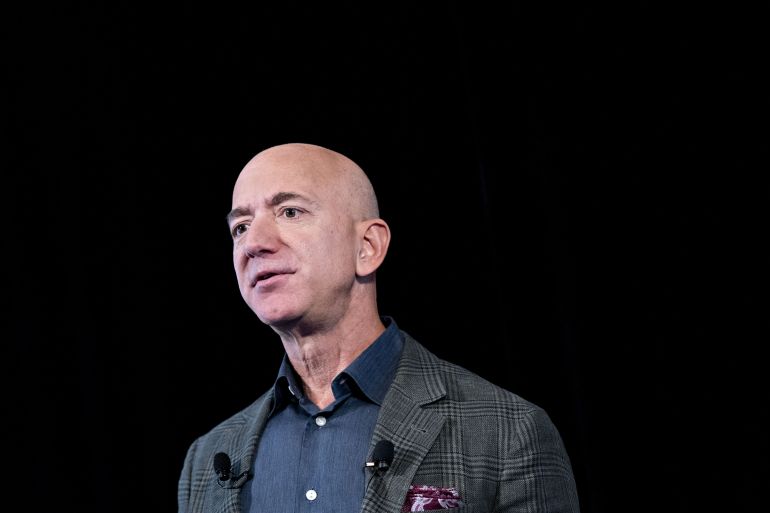

Meanwhile, Biden’s plan to hike corporate taxes has picked up some surprising supporters. Amazon founder and CEO Jeff Bezos said in a blog post this week: “We recognize this investment will require concessions from all sides.”

Most people across the political spectrum agree that the nation’s infrastructure is in dire need of an upgrade. But Biden’s plan – like most policy proposals in the US’s deeply partisan landscape – has staunch supporters and vocal critics.

Those rallying behind it hope it could not only fix the nation’s crumbling bridges and roads, but usher in a new era of global tax reform.

Those adamantly opposed to Biden’s blueprint argue it is simply the wrong approach. Brian Riedl of the conservative think-tank the Manhattan Institute derided the American Jobs Plan as a “giant boondoggle” that throws $1 trillion at a “broken system” that has left the US with some of the highest infrastructure building costs and red tape burdens in the world.

But not all economists and policy experts fall into one extreme or the other. Some are not adamantly opposed to making corporations pay more tax. But they do think there are more efficient and equitable fiscal policies to generate funds for Biden’s big infrastructure vision.

Better than debt

For some libertarian economists, raising corporate taxes to fix infrastructure is far from ideal, but they see it as preferable to borrowing the money and leaving future generations with even more debt.

“I do think they need to raise revenue for this plan,” said Scott Sumner, a monetary policy expert with the Mercatus Center at George Mason University. But raising corporate taxes, “would not be my first choice,” he told Al Jazeera, adding that 28 percent isn’t that high and “wouldn’t be a disaster”.

Sumner thinks a tax on polluting carbon emissions would be the optimal way to fund Biden’s plan, but he doesn’t see it as pragmatic because it would be “hard to get through Congress”.

The second-best option, he said, would be to increase the payroll tax on people who make more than $200,000 a year. A congestion tax on drivers entering central business districts is also an approach he likes in theory, but he believes it has no chance of finding traction with lawmakers. “Our system has so many veto points,” he said.

Gilles Duranton, an urban economist at the University of Pennsylvania’s Wharton School of Business, sees some pluses in Biden’s plan – like incentivising corporations to repatriate cash hoards held abroad.

“Lots of American firms were basically piling up money without doing much with it,” he told al Jazeera.

But he says that economists still don’t have “a good answer” as to who actually bears the brunt of increased corporate tax rates — owners, employees or customers.

“Eventually workers are going to pay some, but that’s under the assumption that the world is competitive,” he said. “A good share of profits made by firms is associated with market power, and a good chunk is paid by shareholders.”

A new era

Some policy experts are not bothered by the prospect of further ballooning the nation’s debt or deficit, given that the economy is still recovering from COVID-19 lockdowns and restrictions.

“We’re talking about infrastructure here: it almost pays for itself, raises national productivity, causes fewer accidents and moves goods and services to places easier,” said Rob Scott of the progressive-leaning Economic Policy Institute (EPI).

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, agrees.

“The low cost of borrowing and the pressing spending needs we face right now make deficit and debt reduction a lower priority at the moment,” he said.

Gardner sees the once-in-a-century disruption caused by the coronavirus pandemic as a ripe opportunity to usher in a new era of corporate tax reform to make the system more sustainable and revenue-positive.

“I was disappointed when Congress and President Trump chose to drop the corporate rate from 35 to 21 percent in 2017 without meaningfully paying for it,” he told Al Jazeera. “Undoing half of the Trump rate cut is a sensible response to the huge fiscal shortfalls we now face.”

Gardner published a report last year that backs up Biden’s claims that large corporations use all sorts of accounting shenanigans to avoid paying taxes.

“These companies’ ability to avoid paying even a dime of federal income tax in years when they were highly profitable is especially important because the corporate income tax is the main tax the US has that’s supposed to apply to profitable businesses,” he said.

“[They] should be helping to fund the cost of vital public investments,” Gardner added. “If they’re not paying it, they’re not paying their fair share.”

For EPI’s Scott, just raising tax rates on big tech companies like Apple Inc may not solve the problem of properly taxing outsourced production. He proposes using the sales factor apportionment method that would require all corporations — whether domiciled in the US or abroad — to pay taxes on their share of world profits earned in the US.

To help pay for the second part of Biden’s Build Back Better programme — the American Families Plan to be announced in a few weeks — Scott advocates for a market access charge, or a tax on all foreign investment in the US.

“This does not fall on Americans or people who vote here,” said Scott. “Wall Street will scream ‘bloody murder’ about reduced demand for US assets, but it’s totally ‘America First’.”