As Biden meets CEOs to tackle chip shortage, Intel offers hope

During a White House meeting, Biden said he has bipartisan support for legislation to fund the semiconductor industry.

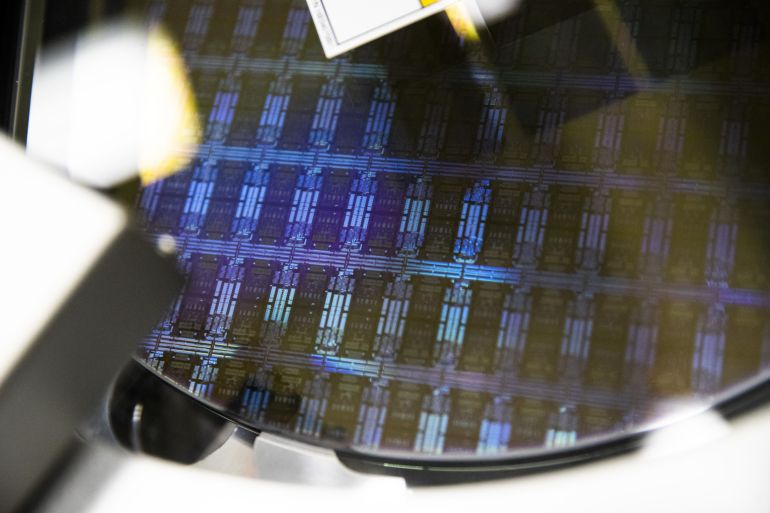

United States President Joe Biden has met with executives from key companies to discuss the global chip shortage that has hit automakers and spurred Intel Corp to announce that it plans to make chips for car plants at its factories in the next six to nine months.

During the meeting on Monday, Biden said he had bipartisan support for legislation to fund the semiconductor industry. He previously announced plans to invest $50bn in semiconductor manufacturing and research as part of his drive to rebuild US manufacturing under a $2 trillion infrastructure plan.

Keep reading

list of 4 itemsNeed a new home router? You could be in for a wait. Here’s why

Global chip shortage on agenda as White House convenes US CEOs

Infrastructure push: White House breaks down needs by state

The global chip shortage stems from a confluence of factors as carmakers, which shut plants during the COVID-19 pandemic last year, compete against the sprawling consumer electronics industry for chip supplies. The latter industry has seen a boom as people spend more time at home.

Biden and his top advisers view the semiconductor shortage as a “top and immediate priority,” the White House said after the meeting.

Intel Chief Executive Pat Gelsinger, who attended the meeting virtually, told the Reuters news agency that the company wanted to start producing chips at its factories within six to nine months to address the shortage, which has idled assembly lines at some US automotive plants.

The supply crunch could lead to a potential 1.3 million-unit shortfall in US car and light-duty truck production this year.

“We’re hoping that some of these things can be alleviated, not requiring a three- or four-year factory build but maybe six months of new products being certified on some of our existing processes,” Gelsinger said. “We’ve begun those engagements already with some of the key components suppliers.”

Scale-up

Intel last month announced plans to vastly scale up chip manufacturing for outsiders as it builds new factories in the US and Europe. Its talks with automotive suppliers disclosed on Monday represent an acceleration of those plans.

The White House meeting included executives from 19 prominent companies, including General Motors Chief Executive Mary Barra, Ford Motor CEO Jim Farley and Chrysler parent Stellantis NV CEO Carlos Tavares. White House National Security Advisor Jake Sullivan, National Economic Council Director Brian Deese and Commerce Secretary Gina Raimondo also took part.

“Today I received a letter from 23 senators, bipartisan and 42 House members, Republican and Democrat, supporting the chips for America programme,” Biden said at the top of the session.

Executives from companies such as GlobalFoundries, Taiwan Semiconductor Manufacturing Co, AT&T, Samsung Electronics Co and Google-parent Alphabet Inc also were in attendance.

Participants emphasised the importance of increasing transparency in the semiconductor supply chain to help mitigate current shortages and improving demand forecasting to help stave off future challenges, the White House said in a statement.

They also discussed “the importance of encouraging additional semiconductor manufacturing capacity in the United States to make sure we never again face shortages,” it added.

Participants discussed short and long-term approaches to address the chips shortage but no immediate decision or announcement was likely to come from the meeting, White House Press Secretary Jen Psaki told reporters.

Broadband internet, cellphone and cable TV companies also face delays in receiving “network switches, routers, and servers,” according to an industry group.

Special treatment?

Many of the policymakers supporting additional funding for semiconductors want to see the measure in a standalone competitiveness bill aimed at China, not as part of Biden’s infrastructure package, as it is now. The China bill has some bipartisan support and could have a quicker path through Congress.

But exactly how to spend and allocate the semiconductor funding is a source of debate among automakers and other consumers of chips, as well as the semiconductor companies themselves.

Carmakers are pushing for a portion of the money to be reserved for vehicle-grade chips, warning of output shortfalls if their industry is not given priority.

Yet makers of other electronic devices affected by the chip shortage, such as computers and mobile phones, have taken issue with the carmakers’ demands, worried their industries will suffer. The debate was also a factor in the White House meeting.

The White House has not taken a public position on the issue but has indicated privately to semiconductor industry leaders that it would not support special treatment for one industry, the Bloomberg news agency reported citing people familiar with the matter.

Later this week, the Senate Commerce Committee will hold its first hearing on a bipartisan measure to bolster technology research and development efforts in a bid to address Chinese competition.

“Trying to address supply chains on a crisis-by-crisis basis creates critical national security vulnerabilities,” national security adviser Sullivan said in a statement.