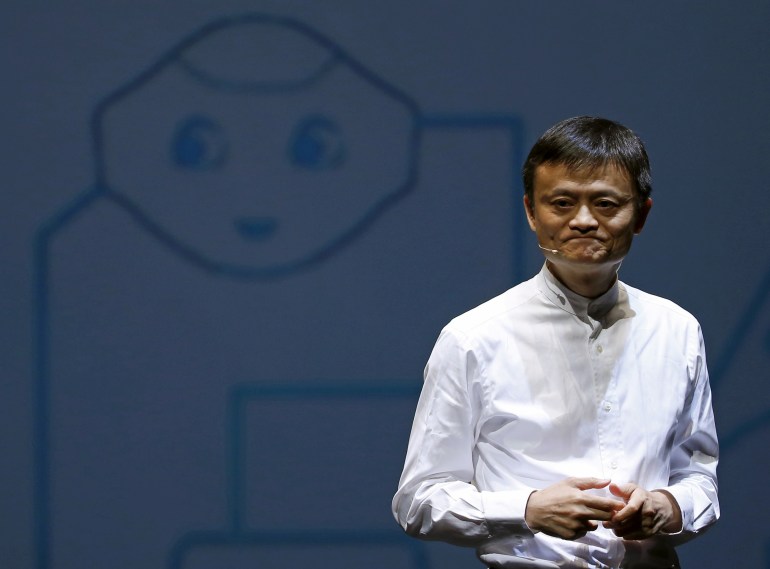

Social media wants to know: Where is Jack Ma?

Alibaba founder Jack Ma has been absent from public view since late October as Chinese regulators clamp down on his business empire.

Alibaba founder Jack Ma’s absence from public view in the past two months – including him missing the final episode of a TV show on which he was to appear as a judge – has fuelled social media speculation over his whereabouts amid a Chinese regulatory clampdown on his sprawling business empire.

China’s highest-profile entrepreneur has not appeared in a public setting since a late October forum in Shanghai where he blasted China’s regulatory system in a speech that put him on a collision course with officials, resulting in the suspension of a $37bn initial public offering of Alibaba’s Ant Group fintech arm.

Keep reading

list of 3 itemsJack Ma’s Ant seeks $200bn valuation in dual IPO

Billionaire Jack Ma is $3bn poorer after Ant IPO put on ice

The Financial Times reported on Friday that Ma was replaced in November as a judge in the final episode of a game show for entrepreneurs called Africa’s Business Heroes.

An Alibaba spokeswoman told Reuters news agency on Monday that the change was due to a scheduling conflict, declining further comment.

While news coverage of Ma’s absence from public view triggered speculation on Twitter, which is blocked in China, it was not a significant trending topic on social media in mainland China, where sensitive topics are subject to censorship.

Chinese regulators have zeroed in on Ma’s businesses since his October speech. Regulators launched an antitrust probe into Alibaba and ordered Ant to shake up its lending and other consumer finance businesses including the creation of a separate holding company to meet capital requirements.

“I think he’s been told to lay low,” said Duncan Clark, chairman of Beijing-based tech consultancy BDA China. “This is a pretty unique situation, more linked to the sheer scale of Ant and the sensitivities over financial regulation,” he said.

Alibaba’s Hong Kong-listed shares fell 2.15 percent on Monday.